How the US Courts Rewrote the Rules of International Trade

Books & the Arts

/

March 3, 2025

Shaina Potts’s Judicial Territory examines how the American legal system created an economic environment that subordinated the entire world to domestic business interests.

A woman passes by posters that read “Enough Vultures—Argentine united in a national cause” in Buenos Aires, 2014.

(Alejandro Pagni / AFP via Getty Images)

Consider the following two stories involving legal disputes between American companies and foreign governments.

In 1919, the ocean steamer The Pesaro sailed from Genoa, Italy, for New York City. Built in Germany for a German shipper and formerly named the SS Moltke, the steamer had been seized by the Italian government in 1915 after Italy entered World War I. On board for its departure to America four years later were 75 cases of artificial silk owned by a company incorporated and based in the United States called the Berizzi Brothers. When The Pesaro arrived in New York after two weeks at sea, however, the Berizzi Brothers cried foul: Only 74 cases of silk were delivered. One had been lost or damaged in transit.

Books in review

Judicial Territory: Law, Capital, and the Expansion of American Empire

Buy this book

Eighty-two years later, a dispute on an altogether larger scale began. In 2001, with Argentina’s economy mired in recession, the country defaulted on around $93 billion of government debt, in what was then the largest sovereign debt default in history. Though a portion of that debt was owed to foreign governments, the default primarily involved private bondholders such as institutional investors. Most of these creditors would eventually agree to restructure the debt for cents on the dollar (thus booking losses), but a minority of the debt holders refused to accept this “haircut.” Like the Berizzi Brothers eight decades earlier, these holdouts, too, were based in the United States, namely a group of Wall Street “vulture funds” that had invested in the debt at distressed prices.

Beyond the fact that both cases pitted American firms against foreign governments, what links these stories is that the firms in question sought legal redress for their grievances. Not only that, but they sought this redress specifically in American courts, and thus by appeal to US law. The Berizzi Brothers sued for $250 in damages; the vulture-fund owners of the Argentinian debt sued for full face value plus interest.

The Berizzi Brothers’ case ended up in the US Supreme Court, and in 1926 the company lost, which is to say that the Italian government won. The Pesaro was owned and operated by Italy, and it was well established under US law that foreign governments (and their oceangoing vessels) were immune from suit in domestic courts. Yes, the Italian government was engaged in this case in a commercial activity, but it was so engaged, the court ruled, in a public rather than private capacity and with a public purpose.

But the Argentine government would not prove so fortunate, twice finding itself on the receiving end of negative legal judgments in its battle with the vulture funds. The first was when the US courts decided in 2012 in favor of the creditor holdouts, ruling that the full bond value was indeed due. The second followed Argentina’s subsequent decision—highly unusual among sovereign debtors in recent decades—to stand firm and continue to not pay up. While the US courts could not directly make Argentina pay, they could and did make life extremely uncomfortable, issuing rulings from 2012 to 2014 that indirectly forced the Argentine government’s hand by prohibiting it from making payments to other creditors unless it paid the holdouts first, and by prohibiting anyone anywhere in the world except Argentina from helping the country make such payments.

Current Issue

This pair of legal battles prompts a number of questions: What role does the law play in the arbitration of economic disputes? How does the direct involvement of sovereign states in such disputes affect that legal function? And what difference does it make when legal and economic disputes involving governments spill across national borders? These concerns have once again moved to the fore, with an explicitly protectionist and imperially minded president having taken the reins of power in America. The transition from The Pesaro and silk to Argentinian bonds and American vulture funds is an essential backdrop against which to answer these questions. In the course of eight decades, US courts seemingly made a decisive turn against foreign governments, stacking the deck in favor of American companies and becoming, in the process, a handmaiden to American empire.

The two stories with which we began effectively bookend the account of transnational commercial law that Shaina Potts, a geography professor at UCLA, provides in her new book, Judicial Territory. Potts’s study is capacious, offering insights on everything from financialization and hegemony to international trade and globalization. But at the core of the book is the history of how we got from US courts being willing to rule in favor of foreign governments and against American firms in the 1920s to the opposite outcome in the 21st century.

In a nutshell, that history is a chronicle of expanding US judicial authority over the economic decisions and activities of foreign governments, and in particular their relationships with private—usually American—companies. Governments that had previously been treated as sovereign and immune, such as the Italian government in its ownership and operation of The Pesaro, are no longer accorded such deference by US courts. Foreign states and their commercial dealings had not formerly been beyond the reach of US power altogether: The United States’ executive branch had rarely granted them immunity, especially when American interests were involved. What changed was that the US judiciary started to treat foreign governments exactly like private corporations, robbing them of any special legal status. This, as Potts describes it, was an epochal shift.

The change began in earnest in the 1950s and ’60s, and it was initially centered on what came to be termed “the Third World” and on developments in various postcolonial countries. Independence for such countries was frequently followed—albeit sometimes not until decades later—by the nationalization of foreign-owned assets and by the establishment in their stead of state-owned enterprises. Bolivia, for instance, nationalized its tin mines; Turkey nationalized its railways, ports, and utilities; Egypt nationalized the Suez Canal; and countries ranging from Iran to Mexico nationalized their oil industries.

Such nationalizations, which were integral to the plans of developing countries for a New International Economic Order, had long been regarded as beyond the purview of US law. But after World War II, a shift gradually occurred, and American courts increasingly came to treat the nationalization of US assets as unlawful expropriation. The nationalizations in Cuba on the heels of its revolution—Castro famously nationalized all American-owned sugar companies in 1960—were a particular flash point and are given special attention by Potts.

The path from The Pesaro to Wall Street vulture funds, and the markedly different legal treatment accorded to the latter, were enabled by transformations—halting, uneven, and in certain respects still ongoing—in two main legal doctrines that had historically insulated foreign governments from US courts. The first concerned foreign sovereign immunity rules: Who and what were immune from lawsuits? In the 1950s, both the who and the what began to be understood by US jurists in more restrictive ways, with the result that the commercial acts of foreign states—such as Italy’s conveyance of silks to America—lost their former immunity (through the so-called “commercial exception”).

The second key doctrine was “act of state.” This international legal principle asserts that acts carried out by sovereign states in their own territories—such as nationalizations—cannot be challenged by other countries’ courts. Historically, US courts fully respected this doctrine, but by the 1960s they’d started to chip away at it. In particular, commercial acts came to be excluded, just as they were from foreign sovereign immunity rules. Increasingly, it didn’t matter to US courts who a business operator or asset owner was: The activities and possessions of all economic actors (be they public or private) were no longer protected by the rules of sovereign immunity and acts of state.

The expansion of US judicial authority that resulted from the parallel transformations of these two doctrines has been as audacious as it has been largely unnoticed outside of narrow legal circles. It has also been multidimensional: While the juridical encroachment on foreign sovereignty has perhaps been most notable in cases of financial contracts (with creditor rights typically being privileged, as with Argentina’s debt), the phenomena newly falling within the ambit of US law are far more extensive. Anything that conceivably could be subjected to the transnational application of US domestic commercial laws has been. This includes, for example, cigars: A landmark case was Alfred Dunhill of London, Inc. v. Republic of Cuba (1976), in which the US Supreme Court ruled against the Cuban government, which had nationalized the cigar industry and subsequently refused to return the money mistakenly paid to it for pre-nationalization cigar shipments by importers in the United States. All that has been required to bring foreign governments to heel, Potts shows, is to successfully argue that the relationships or activities in dispute are “merely economic” (that is, private and commercial) rather than public and political, which is an argument that US courts have been increasingly happy to accept.

Meanwhile, alongside this expansion of what is litigable in the United States, more striking still has been the expansion of who can be sued and where the relevant activities or assets are located. Today, no sovereign government can operate without the risk of falling afoul of US laws and being held so accountable, and this is true wherever in the world they happen to be operating. Indeed, while making foreign governments subject to US laws for what they do in America is one thing, making them subject to these laws for what they do elsewhere, including in their own countries, is something else entirely. Yet that is precisely what has come to pass.

In 1990, the Nigerian government found itself embroiled in a US court case involving a contract it had awarded for the construction of a military hospital in Nigeria. Why? One American firm had accused another of having secured the contract through the bribery of Nigerian officials. The US Supreme Court decided that it did have the power to adjudicate the bribery accusation, thus reminding foreign governments the world over that they cannot deal with American firms, even at home, without considering how US courts will judge those dealings. (President Trump has recently weighed in on the appropriate course of judgment, telling US jurists to stop ruling against such bribery: “It’s going to mean a lot more business for America,” he said.) As Potts insists, it is surely a sea change of profound political significance that, over the course of several decades in the post–World War II era, the US legal system has “helped make the whole world part of US economic space.”

The transformations discussed in Judicial Territory are, as Potts admits, familiar ones to certain legal experts and well documented by legal historians. The particular importance and value of her new account lies in refusing the idea—implicit if not always explicit in the bulk of the existing literature—that this is merely a technocratic history, consisting merely of technical juridical tweaks. This process was not technocratic whatsoever, but partisan and nationalistic—thoroughly political from start to finish.

To begin with, the timing of the commencement of this shift in legal treatment—in the 1950s—was anything but happenstance. It coincided both with an upsurge in the socialist and postcolonial nations pursuing economic development models that prioritized domestic populations and industries rather than multinational (increasingly, US) capital, and with the diminishing potential for powerful Western countries to strangle those upstart development models in ways they had in the past. The American courts’ growing subordination of the international arena into merely another jurisdiction of US domestic law is part and parcel, then, of a longer and larger historical policy of containment.

Hence, the history that Potts narrates refuses technicist readings every step of the way. Behind the expansion of US judicial reach in the second half of the 20th century was the desire and determination of US government and corporate actors to tame statist national economic models overseas and to nip in the bud any developments remotely inimical to the interests of US capital. Much of the richness of Potts’s account is found in its careful identification of the primary nonjudicial actors (the private companies, investors, and policymakers with intimate connections to both constituencies) that animated and motivated these historical juridical transformations.

The value and importance of Judicial Territory also lies in Potts’s assessment of the consequences and indeed intrinsic nature of the massive expansion of US judicial authority. One of the most enduring puzzles of the postcolonial age has been the question of why previously colonized countries so frequently failed to flourish once the colonizers were sent packing and formal sovereign status had been achieved. Potts does not exactly situate her study as an answer to that question, but an answer—one adding to and complementing a range of existing answers—is nonetheless what she indubitably provides. Postcolonial nations have widely failed to thrive, Potts effectively argues, because in reality they remained part of a de facto empire, although in this case an American as opposed to a British, German, or Spanish one; and this has served to undermine their nominal sovereignty.

In fact, the refreshing thing about Potts’s book is that she makes no bones about it: Imperialism is clearly what we are dealing with here. But it is a different type of imperialism, one where exogenous judicial authority increasingly stands in for military or executive authority. Her book is a call to treat the United States as an imperial power precisely (although not exclusively) because of this extension across international space of US legal authority and, correspondingly, of the interests of US capital. Potts writes of the latter-day American empire evincing a “judicial modality”—of foreign sovereign nations and their peoples being subordinated to America by law rather than by colonial occupation or military force.

What is perhaps most insidious about the “imperial modality”—another striking Potts framing—of US judicial power is the extent to which it was designed to quietly snuff out “postcolonialism.” The expansion of US judicial territory after World War II, Potts writes, “enabled the United States to continue exercising substantial authority over the decisions of foreign governments in an age of avowed anti-imperialism and formal sovereign equality.” More than that, the turn to law was a mechanism of the active disavowal of empire. “The recoding of many foreign policy issues as merely legal,” Potts notes at one point, “has been an especially potent way for the United States to obscure its own imperial operations.” Or, as she puts it elsewhere, the trick has been “to cloak the pursuit of US geopolitical and geoeconomic goals (always entangled to a large degree with private corporate interests) in the guise of the ‘rule of law.’”

For that, of course, is the thing about law: its self-professed impartiality and, well, judiciousness. A modern-day empire rooted in law, of all things? The very idea seems counterintuitive, absurd even. Yet that is what Judicial Territory presents us with: empire camouflaged by the veneer of fairness that the law furnishes. If, as Carl von Clausewitz famously argued, war is merely the continuation of politics by other means, then, for Potts, law—at least the transnational application of domestic American commercial law—represents the continuation of empire by other means.

Just as Indigenous populations worldwide resisted the imposition of foreign occupation and rule that was European colonialism, so too have national governments worldwide—to varying extents and with varying degrees of determination—resisted and challenged the postwar expansion of US judicial authority. Potts recounts many such examples of confrontation. The Cuban government has long been a particular irritant for the United States in this respect, repeatedly and robustly arguing against the overreach of American judicial authority.

But Potts is also clear-eyed about the fact that, for the most part, these challenges have ultimately been in vain: “Once judicial decisions are made,” she observes, “most foreign governments do obey them most of the time.” But why? After all, as Potts notes, “transnational law is not backed directly by the enforcement power of the police the way domestic law is.” Her answer emphasizes the chilling impact of the economic blackballing that routinely comes with not conforming: “Foreign governments simply cannot afford to be locked out of US markets or legal services.”

Popular

“swipe left below to view more authors”Swipe →

The case of Argentina’s defaulted debt and the vulture-fund holdouts appeared, at least, to represent something of a counterpoint to this tendency. When the US courts initially ruled in 2012 that the country did have to pay the vulture funds in full, Argentina continued to refuse to do so. It held firm.

But that was not the end of the matter. As mentioned, the courts proceeded over the next two years to ratchet up the pressure further—effectively blocking Argentina from paying its other bondholders unless it first paid the holdouts in full—and in the end, the government buckled: In 2016, it settled with the vulture funds to the tune of more than $10 billion. Why? Argentina had essentially been excluded from the international capital markets while making its stand, compounding its domestic economic strife. Settling with the holdouts enabled Argentina to restore its credibility in the markets, issue new debt, and take measures to stabilize its economy.

In the end, Argentina had no real choice, besides isolationism, other than to settle. Settling was structurally required of it, given the country’s dependent positioning in the circuits of international finance. Economists call this structural bind “international financial subordination,” by which they mean that fundamental inequality in the global financial system structurally subordinates less powerful states and constrains their financial autonomy. What Potts has brought to light with Judicial Territory is the crucial role of the law in fashioning and enforcing such subordination—that is, in demanding and securing the obedience of sovereign states.

And the vulture funds? They made out like the bandits. According to data published by the courts in conjunction with the 2016 settlement, the funds each earned returns on investment of between 300 and 1,000 percent. But in its own analysis of the numbers, The Wall Street Journal found that one fund, Florida’s Elliott Investment Management, had actually achieved a return of up to 1,400 percent.

Elliott was very much the public face of the vulture funds in the lengthy battle with Argentina, receiving endless brickbats for its leading role in facing down the Latin American sovereign. Indeed, the normalization of the term “vulture” to refer to Elliott and the other investment funds involved in the litigation plainly indexed the way they were widely viewed: as operating somehow beyond the acceptable pale. “Elliott is the ugly face of America,” one critic, capturing the mood, exclaimed in 2018.

But to suggest that an investment fund such as Elliott is an aberration from contemporary American capitalism is to miss the point entirely. Insofar as it trades on the rule of law that the United States propagates and exercises globally, Elliott is American capitalism’s globalizing arm, its vanguard rather than black sheep.

Argentina’s government was demonstrating an “inexhaustible disregard for the rule of law,” Paul Singer, Elliott’s founder and president, opined in a letter to his clients at the height of the dispute. In 2014, a banker who’d done business with the firm was asked by a journalist what made Elliott so successful. “They have deep respect for the rule of law and they expect others to share it,” the banker said. But what would happen if Singer and his colleagues ever sensed that others did not share this “respect”? “I think you know the answer,” the banker replied.

Donald Trump’s cruel and chaotic second term is just getting started. In his first month back in office, Trump and his lackey Elon Musk (or is it the other way around?) have proven that nothing is safe from sacrifice at the altar of unchecked power and riches.

Only robust independent journalism can cut through the noise and offer clear-eyed reporting and analysis based on principle and conscience. That’s what The Nation has done for 160 years and that’s what we’re doing now.

Our independent journalism doesn’t allow injustice to go unnoticed or unchallenged—nor will we abandon hope for a better world. Our writers, editors, and fact-checkers are working relentlessly to keep you informed and empowered when so much of the media fails to do so out of credulity, fear, or fealty.

The Nation has seen unprecedented times before. We draw strength and guidance from our history of principled progressive journalism in times of crisis, and we are committed to continuing this legacy today.

We’re aiming to raise $25,000 during our Spring Fundraising Campaign to ensure that we have the resources to expose the oligarchs and profiteers attempting to loot our republic. Stand for bold independent journalism and donate to support The Nation today.

Onward,

Katrina vanden Heuvel

Editorial Director and Publisher, The Nation

More from The Nation

The Pakistani qawwali icon sang words written centuries ago and died decades ago. He’s got a new album out.

Feature

/

Hasan Ali

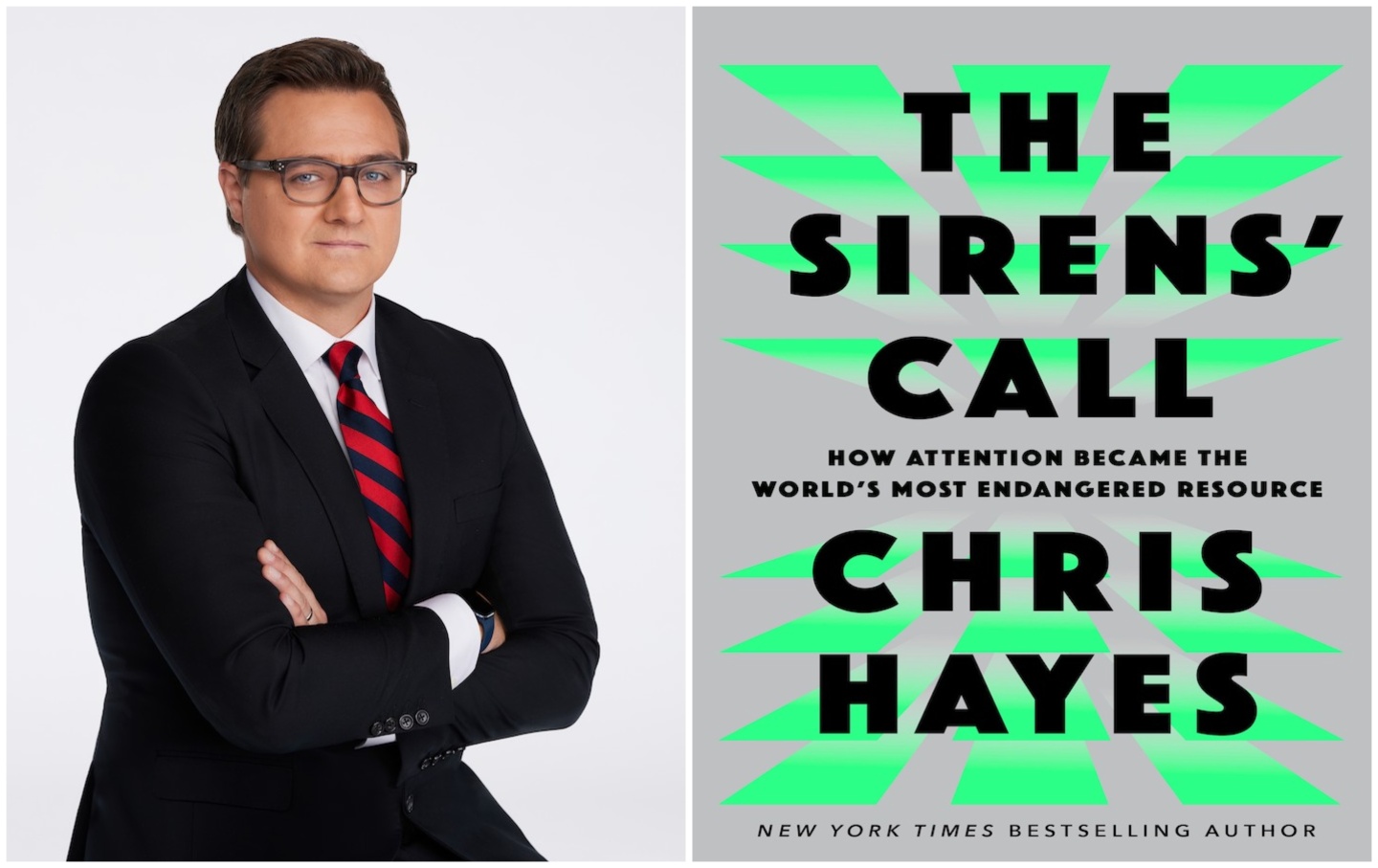

The Nation spoke with the journalist about one of the the biggest problems in contemporary life—attention and its commodification—and his new book The Siren’s Call.

Books & the Arts

/

David Klion

During the Berlinale’s 75th anniversary, it felt like the world was coming apart—but at least we had the “borderless realm” of film.

Linda Mannheim

An inheritor of a distinct tradition that stretched back to Coleridge and Emerson, Johnson’s naturalistic poetry was immersive and intimate all at once.

Books & the Arts

/

David B. Hobbs